The global fintech market is booming and expected to reach $324 billion by 2026. This gives fintech marketers more opportunities to grow their customer base, but they’ll be doing so alongside an increasing number of fintech businesses vying for prominence – not to mention banks that are doing all they can to keep their hold on the market against fintech companies.

With such tough competition, falling behind on current fintech trends puts you at risk of losing customers-and losing revenue. Companies that capitalize on the latest fintech trends as part of their marketing strategy will thrive in this growing field. In this piece, we’ll cover five key fintech trends and how you can use them to attract and retain consumers, build lasting brand credibility, and set yourself apart from the crowd.

1. Referral Marketing Programs Keep Growing

Refer-a-friend programs continue acting as a valuable tool for generating new, loyal customers. As brand consulting company Kantar notes, recommendations from friends and family are consumers’ most trusted form of advertising.

Extole’s Chris Duskin agrees: “Which do you trust more: an autoplay video on your Twitter feed, or your best friend tweeting that they love and recommend a product? As consumers become warier of and fatigued by ads, referral marketing continues to shine.”

Today’s leading fintech brands are implementing refer-a-friend programs that harness this power of reciprocal consumer trust to grow their user base and brand credibility. For example, fintech giant Robinhood was an early adopter of referral marketing and used it to gain nearly one million users before the stock trading and investment app even officially launched in 2014.

Other emerging fintech brands continue to follow suit, including:

- Wealthsimple: With five different fintech products, Wealthsimple offers a host of different referral incentives. For its investing app, referring and new users get free management of $10,000 in assets for 12 months. The company has over 1.5 million users and was just selected as the first Canadian payment service for Twitter’s Tip Jar.

- PrizePool: PrizePool launched in August 2020 and motivates customers to save more money by linking their savings with opportunities to win prizes. Their referral program rewards both the referring user and the new user with a bonus 10% on prizes. PrizePool is on track to give away $1 million in prizes by the end of 2021 and reached $10 million in Series A funding in June.

- Step: A mobile banking service for teens, Step gives users $3 for every friend they refer. Users become eligible to join the Step Squad program and earn $10 for each referral after they make three referrals and take additional actions like subscribing to Step’s newsletter. Step has amassed over 2 million users since its app launched in September 2020.

Source: Wealthsimple. Wealthsimple’s referral program offers a unique service to referring and new users.

How to Apply This Fintech Trend to Your Marketing Strategy

- Consider adding unique non-monetary incentives to your referral program that bring additional value to the consumer experience. For a fintech company, this could be adding extra service offerings that encourage users to invest more, or you or could offer 30 minutes of financial consulting.

- Make your referral program more interesting and interactive with gamification. Not only does this generate more user interest, but it also helps consumers to perceive your fintech brand as friendly and accessible.

- Implement a double-sided or tiered referral marketing program structure to drive participation. Double-sided rewards help you quickly grow your user base, and tiered programs like Step Squad offer more return on investment – users are more active in referring so they can achieve more benefits.

- Tailor your referral rewards to the needs of your demographic. For example, Step’s easy cash rewards are perfect for teens who haven’t built up many assets yet. You’ll get the most out of your refer-a-friend program by marketing to a strategic audience instead of trying to appeal to every segment.

2. Customers Struggle with Financial Literacy

A lack of financial literacy impedes financial success – and this key skill doesn’t come easily to today’s consumers. Wealth management company eMoney found in its 2020 Financial Wellness Survey that the two biggest barriers to consumer financial wellness are “getting or finding reliable/good/sound financial advice” and a “lack of understanding or financial education.” Fintech companies that assist consumers in these areas will gain a critical competitive advantage over competitors.

While 78% of U.S. adults say they could benefit from professional financial advice, fintech brands stand to benefit the most by focusing on assisting millennials. Millennials use fintech tools the most out of any working-age demographic, but they have the worst financial literacy. This stems from a lack of access to resources rather than a lack of interest, as 68% of surveyed millennials who were offered financial literacy classes participated in them.

Researchers have also found that financial stress and anxiety are linked to low financial literacy levels. Professional services firm PwC found that 63% of employees reported feeling increased financial stress because of COVID-19, and millennials were the most stressed among all working-age demographics.

How to Apply This Fintech Trend to Your Marketing Strategy

Consumers (particularly millennials) want simple, accessible content that educates them on key financial lessons. The popular social media platform TikTok has reaffirmed this, with a growing number of users now giving personal finance tips geared toward young adults, minorities, and low-income individuals.

Source: TikTok: HerFirst100. Podcaster Tori Dunlap has 1.7 million followers on her TikTok account, where she shares financial strategies to educate and empower women.

Whether it’s a blog post, a webinar, or a social media post, you want to offer easy-to-understand content that teaches users and helps them make informed financial choices based on their needs. This creates a stronger emotional tie to your brand based on consumer appreciation and trust. You can also use educational content to generate more brand awareness by explaining how your tools and services can help users with different financial problems.

You also want to ensure that consumers are receiving high-quality customer support. Using a combination of AI chatbots and traditional customer service representatives lets users get quick answers to questions and frees up employees to provide more one-on-one help solving complex problems unique to each individual.

Expand Your Finserv Customer Base With Referral Marketing

The Finserv market is growing at a furious pace. Leverage your advocates to capture new clients and drive more growth.

Get the Guide3. Customers Want More Personalized Services

Consumers support companies that help them feel seen as an individual and not just a number. Management consulting services company Epsilon found that 80% of surveyed consumers were more likely to buy from a brand that offered them personalized experiences. This means “designing or producing services and products to meet customer’s individual requirements,” according to customer insight platform Lumoa.

By connecting with consumers on a personal level, you’re more likely to retain them – and this emphasis on generating custom solutions for them translates to an estimated 10% increase in revenue. Software and consulting company NCR adds that personalization in the digital space is “not just selling another product to another someone,” but “delivering value” by giving context to how your fintech brand will benefit each unique individual.

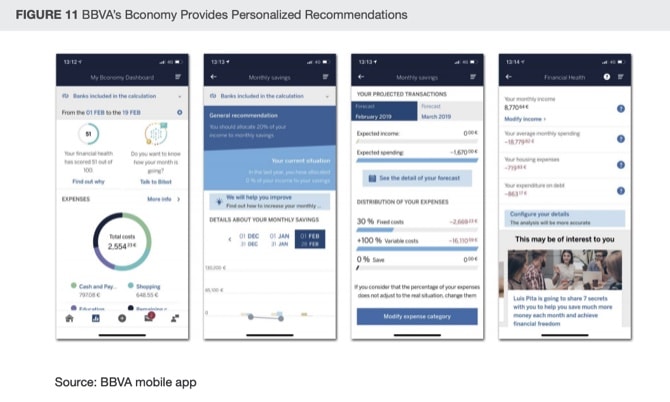

Source: Forrester Research / Fintechnews. BBVA’s app offers customized recommendations to users to help them reach their financial goals.

Personalized fintech solutions also help you connect with a wider range of consumers by taking different financial priorities and personal factors into account instead of trying to give one-size-fits-all solutions. In examining COVID-19’s impact on finances, for example, there are significant disparities between upper and middle-class white Americans and lower-income and Black and Hispanic adults. You can create a more inclusive brand by taking these differences into account when crafting recommendations, products, and services that set consumers up for their version of financial success.

With AI driving fintech forward, these companies also have an advantage when it comes to delivering personalized services –94% of traditional financial institutions aren’t currently using advanced personalization technology.

How to Apply This Fintech Trend to Your Marketing Strategy

Emphasize the use of AI to deliver custom, data-driven services and solutions to consumers. This increases revenue and delivers a positive customer experience where consumers feel recognized and taken care of.

In your marketing materials, promote this attention to personalization by highlighting different financial tools and options for users across economic statuses and backgrounds. It’s also a smart idea to craft content showing how your company can help with prevalent financial concerns related to COVID-19, such as increased debt.

4. Mobile Finance App Use Is on the Rise

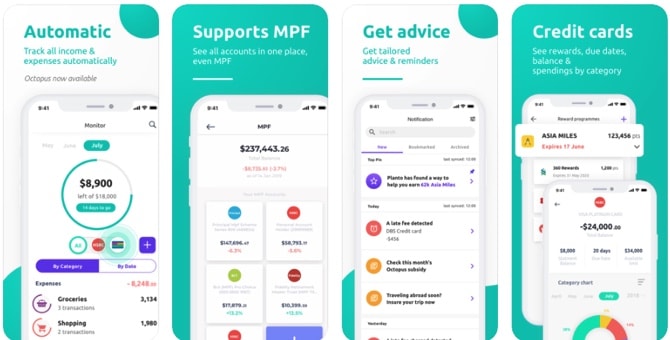

Source: Credencys. Personal finance app Planto syncs with user bank and credit card accounts to track their income and expenses in one convenient place.

Consumers are increasingly looking for efficient mobile financial services. Liftoff and App Annie’s joint Mobile Finance Apps report found that in 2020, consumers downloaded 4.6 billion finance apps across the globe and spent 16.3 billion hours in-app – a 45% increase from 2019.

The study also found that the top fintech apps have a significantly higher user engagement rate than the top traditional banking apps. This isn’t surprising: because the majority of fintech services are digital-only, the stakes for creating a great app experience are higher than for brick-and-mortar banks, where apps are a secondary focus.

This increase in mobile app usage also comes with increased consumer expectations for companies to protect all of their financial and personal information. Proper cybersecurity measures are critical for your app (and brand) to succeed – not only does a data breach erode consumer trust in your brand, but the average data breach costs companies approximately $4.24 million.

How to Apply This Fintech Trend to Your Marketing Strategy

Put user experience (UX) design and cybersecurity at the forefront of your app and promotions. Great UX design makes the app visually appealing while creating an interactive, seamless experience that users want to come back to.

It’s also critical to use a secure identity management and authentication tool in your app login process to protect sensitive user data from cybercriminals. You’ll give consumers peace of mind knowing you’re adding extra layers of digital security to maintain their privacy.

5. Cashless Transactions Are Becoming More Popular

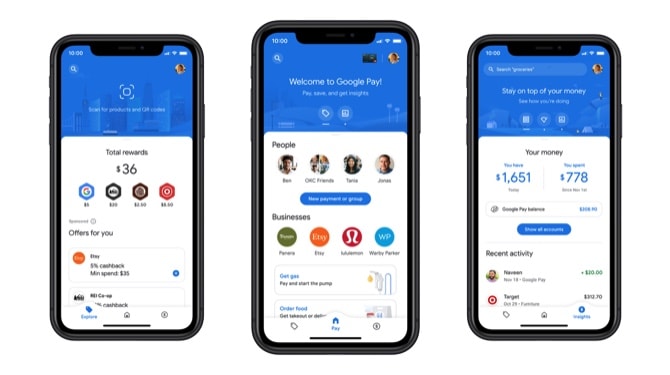

Source: TechCrunch. The Google Pay app lets consumers pay businesses and friends and suggests relevant discounts to help them save on purchases.

Since 85% of Americans have smartphones, it makes sense that consumers are increasingly turning to convenient payment solutions on their mobile devices. Digital financial transactions are projected to triple by 2030, and fintech companies that offer cashless payment methods like digital wallets can remain competitive against the many global central banks exploring digital currencies.

Additionally, offering digital payments can make brands more financially inclusive. A 2020 report from the Federal Reserve Bank of Atlanta suggests that giving low-income cash users “access to digital payment vehicles that don’t depend on traditional bank accounts” is more effective at promoting economic mobility than helping them join a bank.

How to Apply This Fintech Trend to Your Marketing Strategy

Encourage your social media followers to post user-generated content (UGC) promoting the benefits of your cashless tools. UGC helps show the authentic value of a product or service more than traditional ads because consumers trust recommendations from each other, especially on social media. It also helps users feel more engaged with the brand, especially when you re-share the content in your own accounts or turn content creation into a competition with prizes for your favorite posts.

Strategic Fintech Marketing Builds Critical Brand Trust

Technology company Morning Consult found in its 2021 Most Trusted Brands: Financial Services Report that people who are aware of and use fintech services trust them at a level “competitive with traditional providers.” By capitalizing on fintech trends in your brand strategy, you can get more people in the virtual door and further solidify your company’s reputation as a trustworthy fintech entity – one that will hold its own against the competition.

Extole can help fintech companies grow their consumer base with custom referral marketing programs. Schedule a demo today.